U.S. Treasury yields edged lower on Monday as investors awaited key economic reports and prepared for new tariff announcements from President Donald Trump. The 10-year Treasury yield slipped to 4.477%, while the 2-year yield declined to 4.256%.

Key Treasury Yield Movements

- 10-year yield: 4.485% (-0.002)

- 2-year yield: 4.254% (-0.025)

- 30-year yield: 4.702% (+0.011)

Yields move inversely to prices, and one basis point equals 0.01%.

Economic Data in Focus

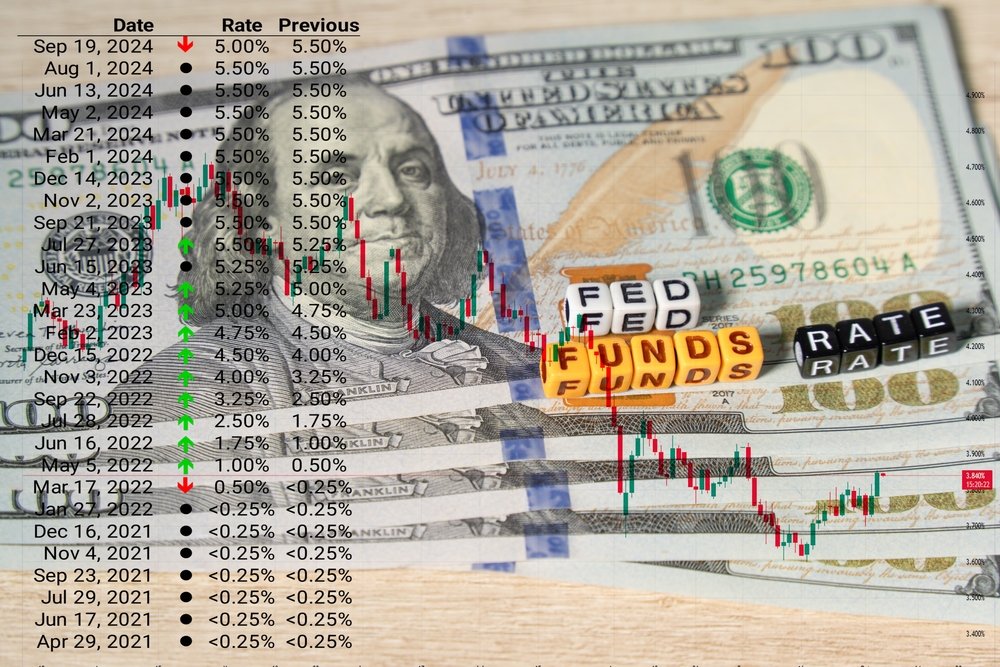

Investors are closely watching upcoming reports that could influence Federal Reserve policy:

- Wednesday: Core inflation data (excludes food and energy).

- Thursday: Producer price index (PPI) and weekly jobless claims.

- Friday: U.S. retail sales data.

Federal Reserve Chair Jerome Powell is also set to testify before Congress on Tuesday and Wednesday, which could provide further guidance on future interest rate decisions.

Tariff Uncertainty Weighs on Markets

Concerns over Trump’s latest trade measures are adding to market volatility:

- The president announced a planned 25% tariff on all steel and aluminum imports, though no start date was specified.

- New China tariffs went into effect overnight on Sunday.

- Trump hinted at retaliatory tariffs on countries taxing U.S. imports.

“Steep tariffs and heightened policy uncertainty could push businesses to increasingly adopt wait-and-see behaviors and pull back on hiring,” said Lydia Boussour, senior economist at EY-Parthenon.

Conclusion

With rising trade tensions and key economic data on the horizon, investors are bracing for potential market shifts. The direction of interest rates and inflation trends will remain in focus as the Federal Reserve weighs its next steps.